When temperatures start to drop, your car may well be impacted. Read on for the three most likely reasons why your car won’t start in the cold, as well as preventive steps you can take.

Why is your car not starting in the cold?

Battery

If your car won’t start in the cold, it’s most likely a battery issue. When the mercury drops, the chemical processes that your car relies on to operate will slow the battery down, as they require more electrical current. Higher usage of elements like your car lights and heater during colder weather will strain a car’s battery, as will the fact that oil flows slower in colder weather as it becomes more viscous.

You’ll know if your battery is flat if you hear a whining noise when you turn the key in the ignition. However, if the battery is completely flat, you’ll likely find that ignition lights and centralised locking systems fail.

How to solve/prevent a flat battery

You’ll need to jump start a flat battery – but never attempt this on a frozen battery, as they can explode. You should always wear protective gear and use jump cables.

Check your battery leads if your car won’t start in the cold. If you can see a thick, salt-like substance, they’ve corroded. You can clean these with a mixture of baking soda and water – but only ever do so once you’ve disconnected your cables.

If your battery is over three years old, it’s probably worth replacing it, as older batteries tend to drop their charge far quicker. In the meantime, it’s worth regularly charging your battery during colder months, particularly if your battery is older and you frequently make short trips.

Similarly, changing and checking your vehicle’s oil levels can help keep the battery optimised – you may even need to change over to a winter-appropriate oil during colder months. But always check your vehicle manufacturer’s recommended oil viscosity rating before doing so.

Car fuel system

Colder weather can cause condensation to build up in your car’s fuel tank, and this moisture can enter the fuel lines. If it freezes, the fuel lines will then block, preventing the engine from running entirely.

You’ll know if this has happened because the car’s engine won’t start. Otherwise, it will probably be very jerky to drive, and may even cut completely whilst driving.

How to solve/prevent issues with car fuel systems

Keeping the car’s fuel tank close to full can help to reduce the risk of condensation. You can also add fuel line antifreeze to your car, which helps to prevent this from happening, and generally ensures that your fuel system is well maintained.

If you suspect problems with your car’s fuel system, you may need to get it professionally flushed. You can also try warming the fuel lines by wrapping them in hot towels and placing a bowl of hot water underneath the fuel tank, which should help to un-freeze any ice particles.

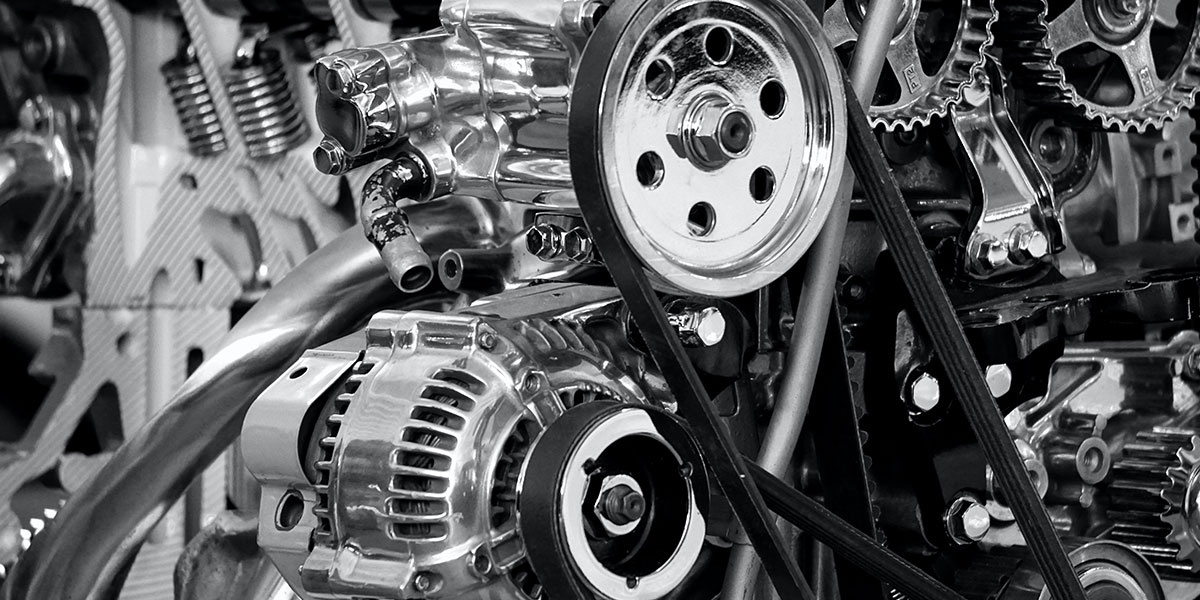

Alternator or starter motor

Your alternator is what generates electrical power in your car, charging your car’s battery whilst the engine is running, and the starter motor uses electricity to kickstart your car’s engine. Even if your car’s battery is brand new, if your alternator or starter motor is shot, your car probably won’t start in cold weather.

If your headlights and dashboard lights flicker, or you notice a burning smell in the cabin, your alternator is most likely faulty. Similarly, if your engine dies after jump starting the car, there’s a problem with the alternator.

If your car’s electrical and lighting system are working, but the engine is refusing to turn over and start, this indicates a problem with your starter motor.

How to solve/prevent issues with the alternator

Reducing stress on the charging system – meaning that you reduce usage of electrical devices and accessories like the radio/MP3 systems and heating – can help with the alternator.

You can check the voltage output of your alternator with a multimetre, but if there is an issue with either your alternator or starter motor, they’ll need to be replaced. This is a fairly complex process and will need to be performed by a professional mechanic.

Find finance in the colder months

If you’re looking for a new car to get you through the winter months, don’t forget to use our car loan calculator to find out what kind of finance you may be viable for. Alternatively, contact us on enquiries@mycarcredit.co.uk.

Rates from 9.9% APR. Representative APR 10.9%

Evolution Funding Ltd T/A My Car Credit

Require more help?

Got a question you can’t find the answer to, or need some advice and guidance around taking out car finance? Our Car Credit Specialists are friendly, experienced, and here to help so get in touch today!